Lots of people who say “I wish I could travel more” just plain haven’t made it a priority. If travel is way down the list after your ginormous house, two new cars, your pets, your latest gadget fixations, and other trappings, then it’ll remain just a wish.

If you really have made it a priority though and still never seem to have enough money to take a proper vacation, then you’re probably not taking advantage of all the travel hacking opportunities that are just there for the taking. The people who fly the most and stay at nice hotels regularly are frequently not paying for a lot of those flights and hotels. They’ve racked up loyalty points through careful planning and strategic spending. As a result, they have a bank of points and miles they can cash in that are worth real money.

Granted, the business road warriors and traveling salespeople you see talking loudly on their cell phone in the boarding area have a big advantage over the rest of us. They’re flying so often they get to elite status with an airline or two, which then becomes a self-fulfilling cycle because they’re earning bonus miles each time their company buys them a ticket. Since they’re often sleeping in the same hotel—or at least the same chain—they get bonus miles there and automatic upgrades.

For us scrounging self-employed and non-corporate types, however, there are still plenty of ways to earn our way to free flights and hotel rooms. It doesn’t even require wearing a suit or making weekly Powerpoint presentations. The four key ways, in order of leverage, are branded credit cards, mileage malls, dining programs, and bonus promotions.

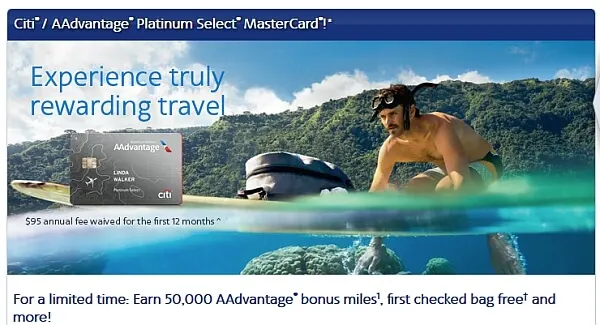

Free Flights Through Credit Card Spending

The credit card angle I cover in detail in this March article I wrote for Global Traveler magazine: Guide to the Best Credit Cards for International Travelers.

The article is geared to international biz travelers, but all of us can use the advice about avoiding foreign transaction fees and having at least one card with a chip instead of a stripe. These work in two general ways: you either earn miles/points with a specific airline/hotel company, or you earn points you can then transfer or cash in when you are ready to travel. You get anywhere from 1 to 5 miles/points per dollar depending on where you’re using it.

The big payoff comes when you sign up, however. From two sign-up bonuses from two airline cards (one personal, one biz) I once got three international round-trip tickets and one was a long-haul to Chile and back. I got 40K bonus miles from my most recent sign-up that I’ll use later for a far-flung vacation.

The next one I’m applying for is a hotel one that’s temporarily awarding 70K points, enough for many nights of hotel rooms. Since it’s the IHG one, there are frequent sales where you can get a room for just 5K, including at the occasional Crowne Plaza or Intercontinental. I also got a Hilton Amex card and have gotten plenty of free nights through them. Follow this link and the current sign-up bonus can get you three free nights or more at some of their properties.

If you’re outside of the USA there are fewer choices, sometimes because of national finance laws, sometimes because they just haven’t caught on yet. But keep your eyes peeled on mileage blogs from your own country, you’re sure to find a few. Pay your recurring bills with these each month and you’ll soon get a free flight or a couple hotel rooms by just paying off that card each month. Here’s more on the basic strategy for free flights and hotel rooms through travel hacking.

Easy Free Flight Earning through Regular Spending

The mileage malls are online shopping portals—most run by the same outsourced company—that pays you miles per dollar each time you buy something. Think Best Buy, Lands End, REI, and Staples, ideally buying stuff you needed to get anyway. You may only get one mile per dollar for that new gadget you wanted, but you may get 20 miles per dollar if you send your sweetie some flowers for her birthday. If you do most of your holiday shopping online anyway, this can be a great way to rack up miles without changing your behavior or spending a cent more. If you run a business and use one of these for laptops, office supplies, or furniture, you could be earning a free flight from this method alone in no time. But there’s a key second step: double your efforts by using that mileage/points credit card to pay for it!

The mileage malls are online shopping portals—most run by the same outsourced company—that pays you miles per dollar each time you buy something. Think Best Buy, Lands End, REI, and Staples, ideally buying stuff you needed to get anyway. You may only get one mile per dollar for that new gadget you wanted, but you may get 20 miles per dollar if you send your sweetie some flowers for her birthday. If you do most of your holiday shopping online anyway, this can be a great way to rack up miles without changing your behavior or spending a cent more. If you run a business and use one of these for laptops, office supplies, or furniture, you could be earning a free flight from this method alone in no time. But there’s a key second step: double your efforts by using that mileage/points credit card to pay for it!

Closely related are the dining programs, also run by a single outsourced company, that serves the major airlines in the USA. You register with any specific credit card and your membership number, then every time you use your card at one of their designated restaurants, you earn extra miles. After you dine out a certain number of times, you get to a higher level and start earning even more points per spend. I’ve used this a lot when I lived in the USA for neighborhood places and favorite watering holes, but if you pull up the list for where you’re going you can keep earning in your travels as well. If you’re lucky enough to have a business expense account, this can be a major earning opportunity over the course of a year.

Bonus programs come and go and are quite hard to keep track of if you’re not getting them fed to you somehow. It’s good to subscribe to sources you like for the latest promos. Here are a few opportunities that came up just this week:

– 500 United miles by joining a program (free) called My Points

– 1K Hilton miles just for changing your account password

– 3K Alitalia miles (or 5K on Alaska if you have their credit card) for booking with RocketMiles

– 1K miles with one hotel chain just for following them on Twitter

– And two weeks ago they posted a promotion that netted me 2K AA miles for booking my $52 Mexican hotel room through a specific place.

Otherwise if you have the time to research you can tune into the chatter on FlyerTalk or follow the blogs that uncover and share these tidbits each week. A lot of them are at The Boarding Area, but a few others I follow include The Points Guy, Lazy Traveler’s Blog, and Million Mile Secrets.

Now I’ve gotta go figure out what I’m packing for my upcoming adventure trip to Peru. I’m going from Mexico City to Cusco and back on 30K airline miles thanks to a promotion they’ve been running this year via my United credit card. On the way back I’m in business class even for the longest leg, on Avianca. Adios!

DML

Sunday 22nd of March 2015

Yes, Dean...I agree with those that call you absurd. I too have gotten numerous free flights with my miles. I find myself primarily flying two airlines (United and Delta) and have for many years based on where I was/am living. Because of that I got credit cards for those airlines. I put general expenses on these cards that I know I will automatically pay off monthly (groceries, gas, etc). Additionally I signed up ages ago for a survey website that allows me to cash in my "$" earned for miles. I regularly add about 5,000 annually to my mileage account just through that alone. But whatever....the more people that think this isn't possible, the more seats available for those of us who use miles.

Jeremy B

Thursday 19th of March 2015

You're not real bright are you Dean? Even a quick skim of the article would tell you this is all about earning miles when NOT traveling. So take all the Ryan Air flights you want when you're paying, but then take a real international one when not. I'm a budget traveler but have earned enough United miles to fly to Asia on Singapore Air and enough on AA to fly to South America on LAN. As a backpacker. You need decent credit, but if you have that you can stack your whole wallet with these cards if you want.

Joey

Wednesday 18th of March 2015

I just got a round-trip to South America for 40,000 miles (less than the credit card sign-up) and one to Europe and back for 50,000 (almost never flew to get those miles either). Thanks to people like you Dean, the rest of us are getting the benefits while you let those opportunities pass you by! I make 35,000 a year before taxes, so this is not out of reach of the normal person.

gary

Wednesday 18th of March 2015

What I'm finding is that airlines are upping the ante with increasing amounts of points/miles necessary to get that 'free' trip. What used to be 80k for a RT biz class ticket to Europe from the States has increased to 120+ k, IF there's an available flight (even in shoulder/off season travel dates). One can also try to book via what's termed as a 'market fare' rate sometimes surpassing 500k miles! Yikes!

That being said, one can find better availability through an airline's FF call center, as available flights posted on the web are usually a fraction of what is ACTUALLY available.

That's been my experience. Your mileage may vary (no pun intended).

Tim Leffel

Thursday 19th of March 2015

You're right Gary in that some biz class tickets have gone up and some economy tickets are not as easy to get as they should be. There are services out there making it their whole job to work miracles and find that elusive L.A. to Hawaii or NYC to Paris ones, for instance. But I've always found that a little flexibility does wonders. I'm losing track of how many flights I've gotten for the lowest possible mileage amount, including a few in the past 12 months. Like anything though, there's a supply and demand element at work. With lots of elite biz travelers upgrading post-mergers, for instance, there are going to be fewer free biz class seats released for mileage cash-ins. The hotel programs are much easier, with a few exceptions like Marriott.

JA

Tuesday 17th of March 2015

@Dean and @single mum - I was skeptical about this approach too, but give it a try with one card if you have good credit. I did and now my wife and I have $1500 in travel credits that we're going to apply to our upcoming flights. Most of the meat of these offers is in the sign up bonus, which is usually 3k in 3 months, which when you plan for it and add an authorized user is really not that hard to get between two people. And please don't think that we are higher rollers at all - we live in a studio apartment and really don't spend much money outside of utilities, groceries and eating out. I really wish I started doing this years ago. Just be sure to pay it off every month because the APRs are absurd.